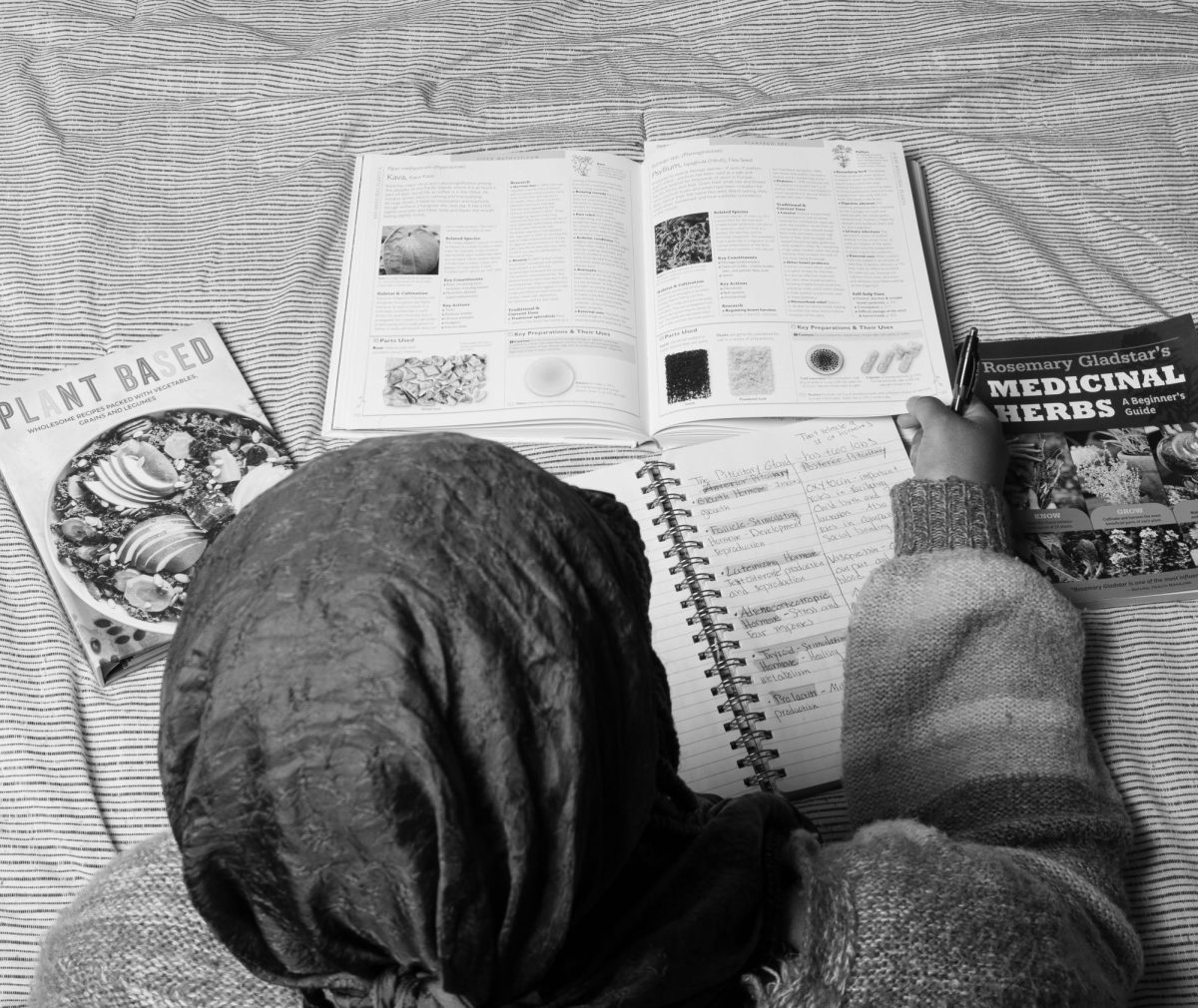

When Tamara Keith was two weeks into her first semester of a photography program she was informed that her financial aid had been pulled. Keith not only thought she met the requirements for financial aid, but she absolutely needed it to go to school.

When she went to the financial aid office for help, however, they made her an offer: Pay $1,300 in the next two weeks and you can get back to school. Unable to pay, Keith had no choice but to cease pursuing her college degree.

Like everyone else, a large part of what determined Keith’s financial aid was how much money her parents make; what was seen on the financial aid side was that her father makes enough money to be able to pay for her education, but the reality of the situation was that Keith’s mother had passed away within the past couple years and that her father, although able to pay for her education, was nowhere to be found.

What happened to Keith was no doubt an unfortunate oversight on the part of the financial aid office and was a definite worst case scenario, but the intricacies of the story show a department that finds itself caught between giving students aid and following procedure.

The problem is that sometimes procedure leaves people like Keith falling through the cracks.

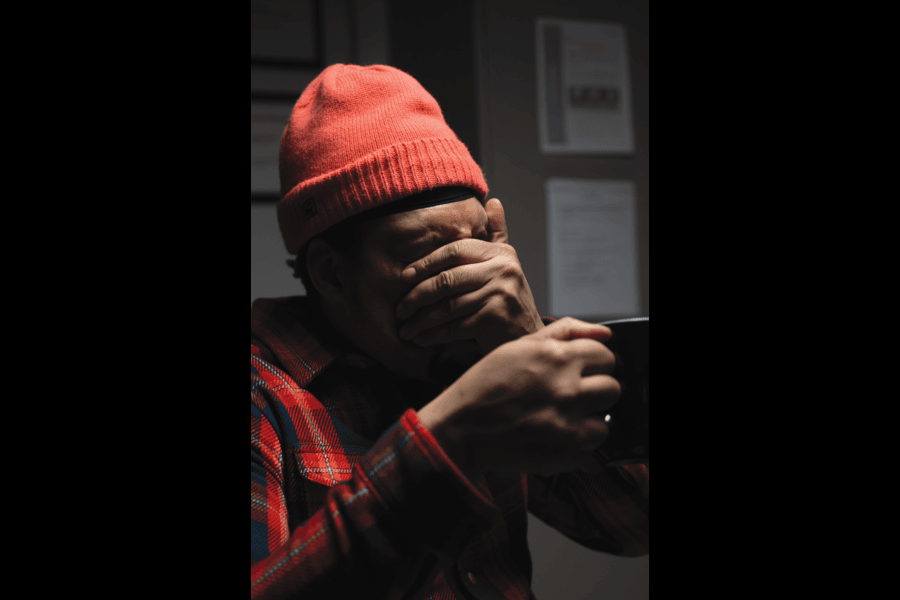

Jerry Manz, the director for the financial aid office, explained the situation from his point of view, “If schools reach a certain threshold or default rate for a period of time, they can actually be removed from the student loan program. That’s why it’s so important for schools to take an active role in default management to try to keep that default rate down and keep that money available for students that actually need those funds in order to go to school.”

Currently, MATC’s default rate is at 19 percent; if it hits 25 percent the U.S. Department of Education begins to step in and put restrictions on the amount a school can lend or, even worse, can begin to eliminate schools from the student lending program.

Manz said, “What a lot of students don’t realize when they take on debt is that as soon as they drop out of their classes or drop below half-time status, which is six credits, the clock starts ticking on the repayment. So, six months after they complete their program or drop below half time they’re going to have the obligation to pay their first loan payment.”

Add to that a pattern of people trying to take advantage of the system as a way to get an easy loan, and it puts pressure on the financial aid department to be tough.

Sometimes however, this results in the punishment of students who are actually trying to attend, or finish school, but don’t have the means to do so. The Department of Education is trying to regulate this situation with a policy known as R2T4 which refers to the return of financial aid that the student hasn’t earned.

Manz says, “If a student receives money then drops out, whether it’s loan money or grant money, they may have an obligation to repay even the grant money, in full, in order to go to any school ever again.”

If the student can’t pay, their case goes to collections; Camille Nicolai, manager of the Financial Aid Office, knows all too well how aggressive collections agencies can be in trying to get the money back. “What’s happening now is, we have people who were students many years ago and now they’re on Social Security; if they have a defaulted loan, the payments are coming out of that person’s Social Security,” she says. “There have also been instances where they’re going into that person’s paychecks, and what they can’t get from the paycheck, they’ll take from your bank account.”

Unfortunately, it may be too late for some but, in order to avoid situations like these, a program named SALT is in the works.

SALT is designed to create financial literacy for students in an effort to create better habits and ultimately a healthier, more sustainable, financial climate in the loan department.

Although not a lot is currently known about the SALT program, the Times will be covering the ongoing developments as the story unfolds.

High loan default rate restricts financial aid for students

February 28, 2013

Photo by MATC Times

Printed Version