Author speaks on dealing with student debt

Photo by Cesar Gaytan

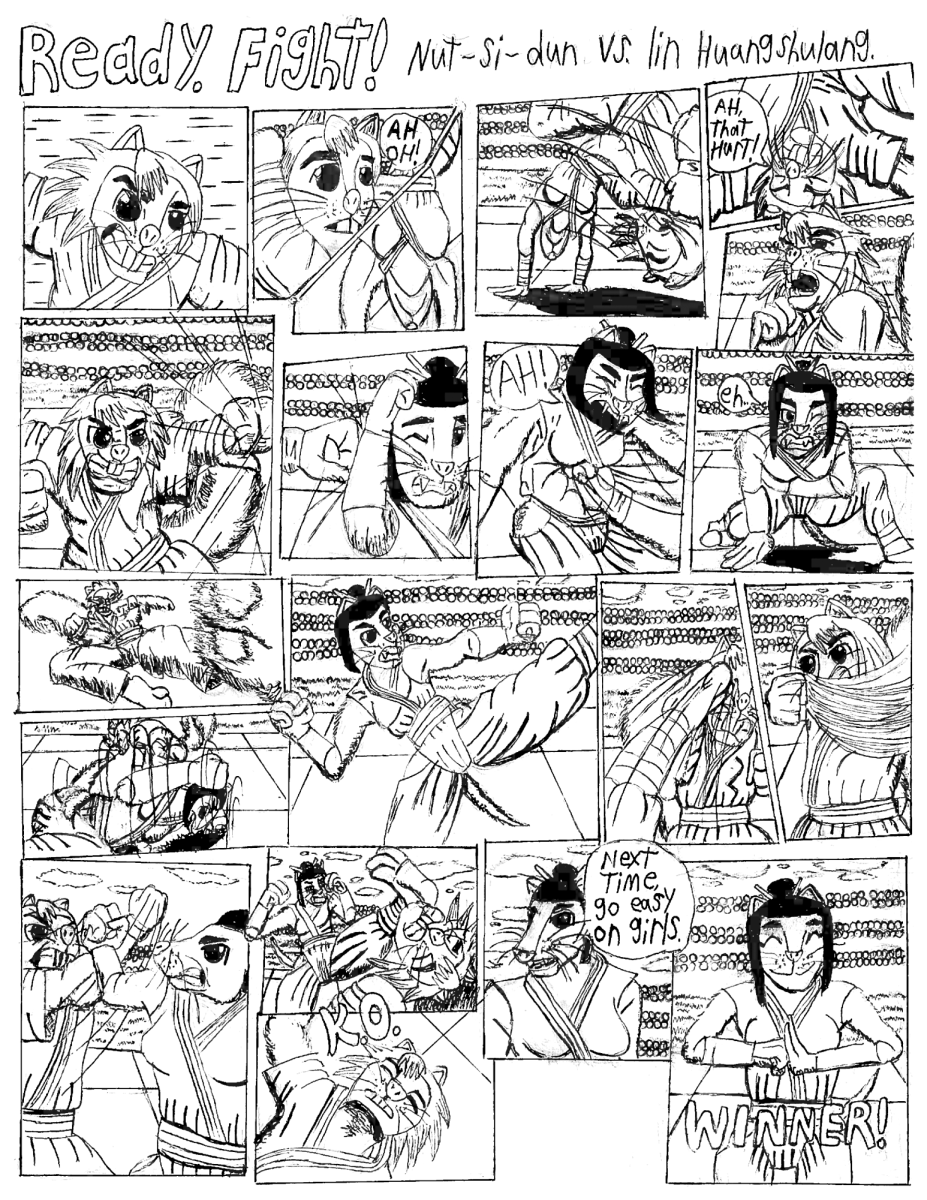

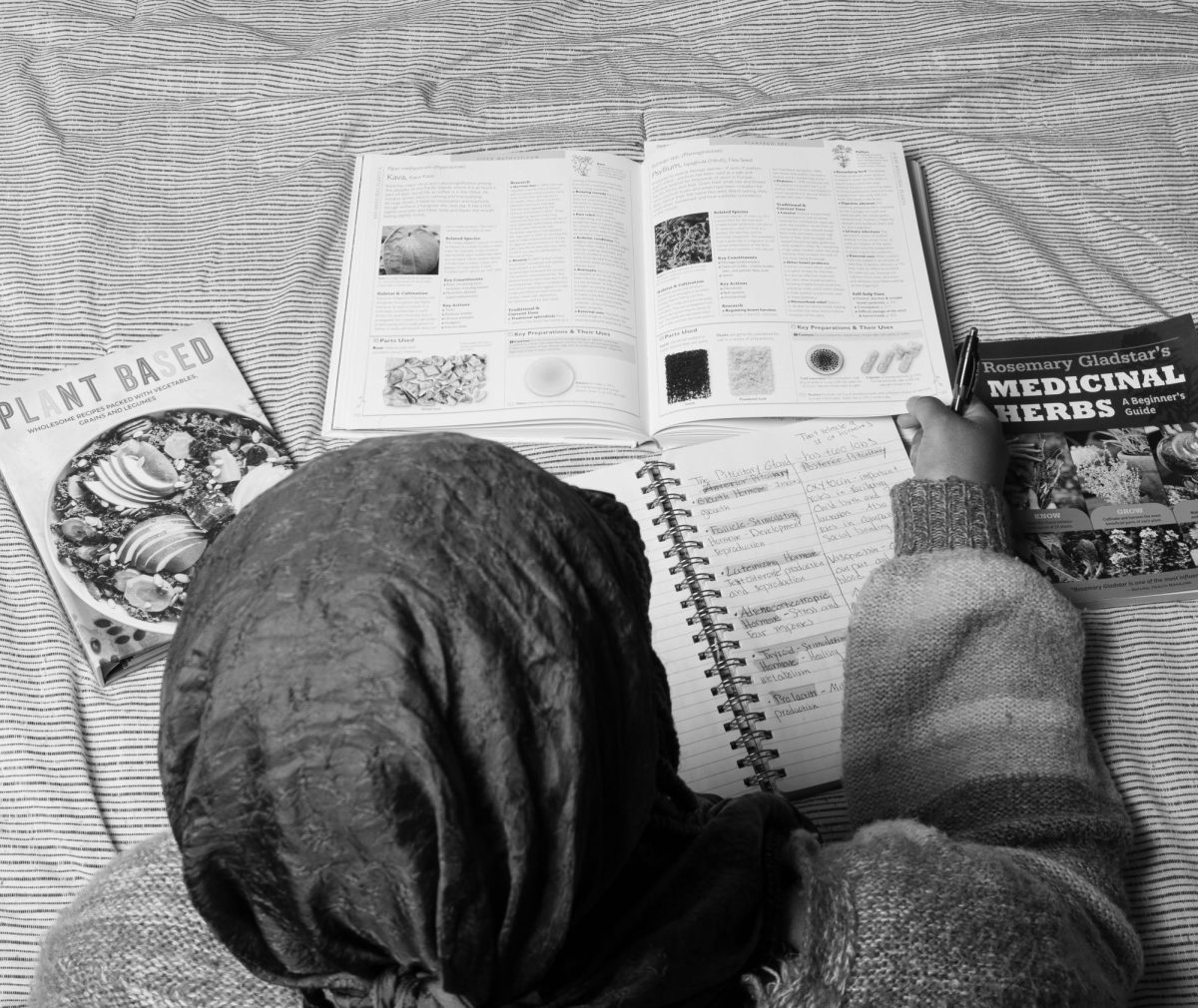

Work and study hard our parents, teachers and peers would say. If we put 100% effort and get our college degree then we should be set for what the world has to offer us. In most cases it doesn’t happen for all us, and in her presentation Sara Goldrick-Rab (above), author of “Paying the Price,” elaborates on how it’s not the best ending for most college students.

On the evening of Sept. 22, in a large auditorium in Milwaukee’s Centennial Hall, the crowd was captivated by a brown-haired woman standing at a podium with a large screen behind her. She began to speak to the people about the massive cuts on postsecondary education that Gov. Scott Walker had proposed. Who is this woman and why are we here?

Before presenting the answers, I will present some staggering and perhaps disheartening statistics concerning American college institutions and students in modern times.

According to Student Loan Hero online, 43.3 million Americans have student loan debt totaling over $1.26 trillion. The average student loan payment is around $351 a month.

Now, I’m not trying to horrify you into not going to college, because it is true that most college graduates have higher paying occupations than those with a high school diploma. This isn’t about fear; it is about understanding.

That is what Dr. Sara Goldrick-Rab, professor at Temple University and Founder of the Wisconsin HOPE Lab, the nation’s only translational research laboratory, is trying to make us understand during her book tour for “Paying the Price: College Costs for Financial Aid, and the Betrayal of the American Dream.”

Goldrick-Rab teaches students around America to understand the true cost of college and how to prevent one from being trapped in this system of debt, anxiety, and money-less life. At this talk and signing she explained how student loans work, the weakness and limits of financial aid, and gave examples of students who had trouble paying off their debts.

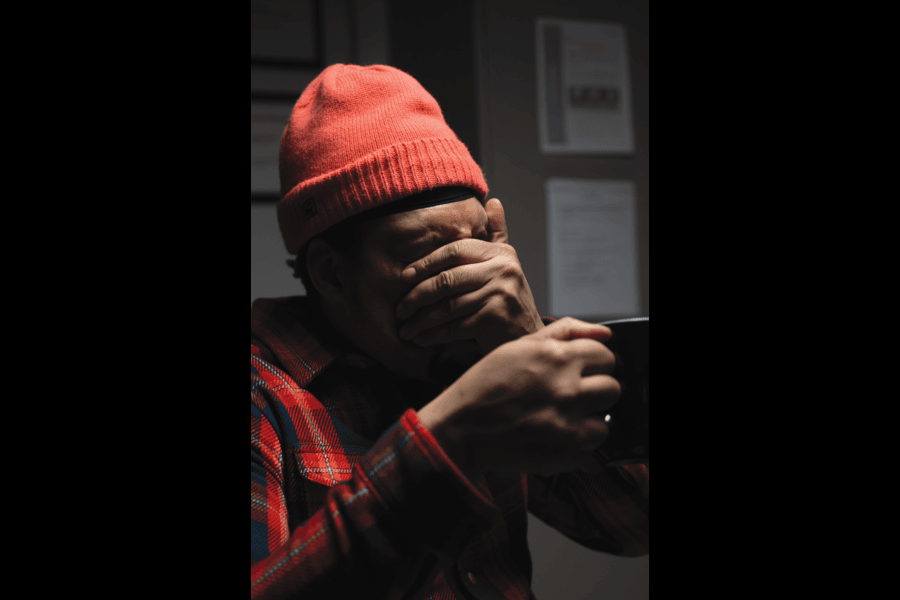

According to Goldrick-Rab, students in college have unhealthy eating habits, often work two jobs, all while trying to get to morning classes without being late or sleeping in class. Money is the primal force that pushes college students to the edge.

Some students are even homeless while attending college. According to Maslow’s Hierarchy of Needs, without the basic needs of food, shelter and security being met, one cannot focus on the self-fulfilling needs, such as higher education and career.

Making college affordable is extremely hard, and difficult situations develop, hence Goldrick-Rab instated the FAST Fund designed to quickly assist students experiencing economic emergencies. One of these funds exists at MATC, if you’re in need.

To learn more about Goldrick-Rab visit her website, saragoldrickrab.com or follow on Twitter @saragoldrickrab.