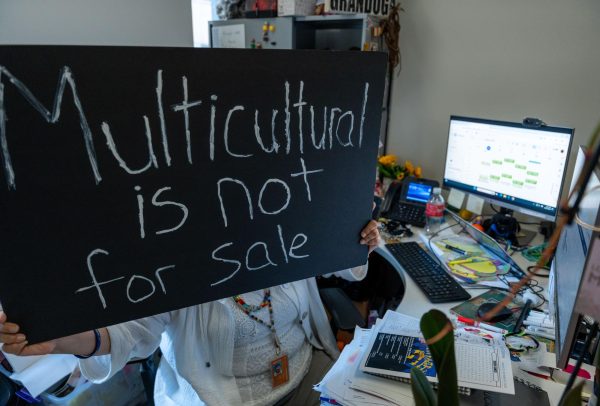

Choice. It’s no longer an option

Imagine a future not too far from now; you are standing in the cereal aisle of the grocery store, mouth open, absolutely agog at the sheer amount of primary-colored boxes of sugar there are. There are so many different types of cereal from a thousand different manufacturers. Only wait, no there isn’t, not at all! The same two, maybe three, companies produce all those bright and happy boxes standing in neat, little, endless rows. This future– it’s actually not the future at all, this is happening Right Now!

According to a 2013 Food and Water Watch Consumer Report, among 100 grocery categories, a handful of the largest companies control an average of 63.3% of sales. In 32 of those categories, four or fewer companies controlled 75% of the sales.

Only 10 companies own the majority of products in the market, from groceries and cosmetics to fast food, dog food, and medicines. You just washed your hair in L’Oreal, threw on a pair of Diesel jeans, and now you’re feeding your baby daughter a jar of Gerber mashed carrots, while the cat is eating Purina hard nuggets, and you yourself are munching on a Crunch bar. That’s all Nestle, folks!

Variety and choice are rapidly becoming an illusion.

So what, pray tell, does all this have to do with cable? How is cereal and denim pertinent to AT&T’s $85 billion buyout deal out of Time Warner? (That’s $107.50 per share, according to NPR.)

I promise I won’t transgress into a paranoid, “Big Brother, 1984” conspiracy rant, but honestly, this deal is a bit concerning.

AT&T becomes a colossus by buying out Time Warner. AT&T is the top provider of phone and internet services, as well as some cable: AT&T U-verse. Time Warner is a beast of a cable and internet provider. It owns HBO, CNN and even Warner Bros. Studio.

With this purchase AT&T now owns U-verse Broadband, DirecTV – as well as – HBO, TNT, TBS, CNN, Warner Bros. and Cartoon Network. AT&T essentially now holds sway over all. If AT&T is the one whose shadow stretches all across the land, preventing smaller companies from realistically having a chance, and basically forces consumers to utilize their product – what will happen with pricing?

Competition drives down prices. We see it all the time. What will happen when AT&T buys out all the choices for phone/cable/internet? Providers rapidly evaporate!

According to the New York Times, AT&T’s rival companies, such as Comcast and Verizon, have also sought acquisitions in an attempt to not drown in the waves created by this buyout. Verizon bought Yahoo and the Huffington Post, while Comcast bought Dreamworks and NBC Universal.

This reaction, to grasp at other companies and incorporate them like a patchwork quilt, mirrors what is happening with the grocery industry. I understand the psychology of it at first; that initial, “I don’t want to die, so I’m going to make myself as big as I can in order to stay alive,” but there is also another side of this. AT&T among many others is guilty of greed, and it’s this greed, which is causing the consolidation of cable, internet and phone service. It’s this greed, which will cause a rise in prices, and there will be little to regulate that pricing.

I am deeply frightened and ashamed to admit this, but I actually agree with Donald Trump on this one. This deal truly is too much concentration of power in the hands of too few!

Variety and choice are rapidly becoming an illusion.