That darn data breach

The astounding tragedy that occurred with the Equifax data breach proves that no matter what “secure” firewalls are implemented to protect us as consumers, no system is foolproof. The irony is that we did not choose this company for any advocacy or representation, nor did we ask for them to be in charge of safeguarding our identities. We were merely coerced into a credit-reporting, credit-scoring system that has compromised our personal information, and potentially put us all at risk.

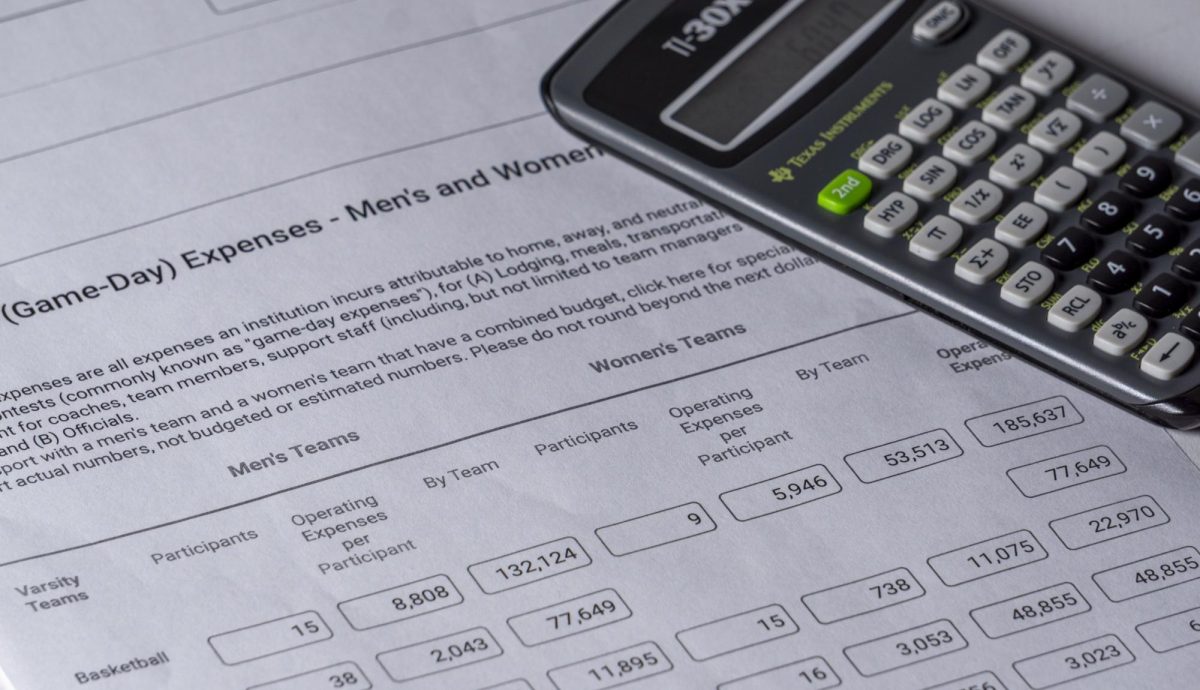

Equifax is one of three nationwide U.S. credit-reporting companies that track the financial history of citizens. The company is supplied with data about loans, loan payments and credit cards, as well as information such as missed rent, utilities payments, addresses and employer history; which all factor into credit scores.

According to Equifax, the personal financial information of 143 million Americans was compromised from mid-May through July. Hackers accessed names, Social Security numbers, birth dates, addresses and driver’s license numbers, leaving consumers vulnerable to identity theft.

The sad reality is the breach of sensitive personal data may be impossible to repair. Most importantly the breach of customers’ trust may prove just as difficult!

So what, if anything, is Equifax going to do to mend the relationships with the dissatisfied, disheartened, disappointed consumers? Are they ultimately left with no choice rather than to unwillingly hand over, yet again, their personal and very private information to a mega corporation that clearly has exposed their information like writings on the wall. Equifax in my opinion has been insensitive, almost unapologetic for their failure to uphold their duty to protect the consumer, and in failure to offer feedback indicating that they will “make it right”; reassuring us that this horrific situation will be rectified. Their solutions appear to be one-sided and almost a double-edged sword of some sort.

It appears that in the early days of its crisis, it was nearly impossible to get a response from Equifax regarding next steps to repair the damage of this dumbfounding incident. Now, as of the latest research, the remorseful company is finally answering some of the consumers’ questions. I have only found their solution helpful for some; here is what they are proposing – a credit freeze. Equifax’s credit freeze process means people lock up their files so that no thief can get new credit by impersonating them. However, this means that if you need a loan as a student, home loan or any type of loan, you will not be able to reap the benefit of this oh-so-gracious gift from Equifax.

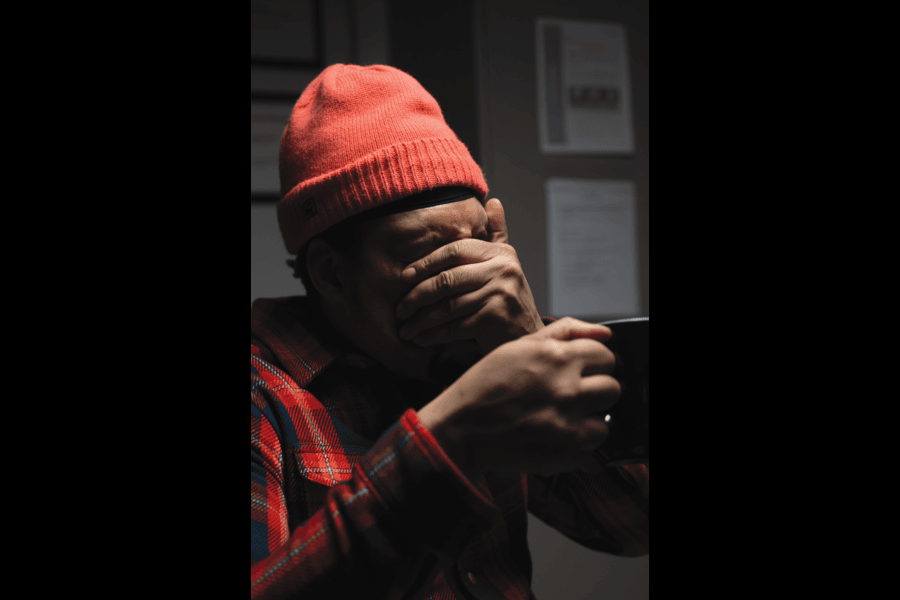

“This is clearly a disappointing event for our company, and one that strikes at the heart of who we are and what we do,” said Equifax Chairman and CEO Richard F. Smith. Smith has now resigned from his position more or less to avoid the aftermath of the breach, or possibly to show his sincere and deepest apologies for his “failure”? Ah, I guess we’ll never truly know. In hindsight we can, and should be, a bit forgiving. Truth of the matter is that no one, or nothing, is perfect. We have of course faced other tragedies in Corporate America, and are no stranger to such existential moments. For example Tylenol faced a familiar dilemma after product tampering, BP after a fatal oil spill, and JetBlue after a disruptive ice storm. A crisis like the one engulfing Equifax requires decisive and transparent leadership mixed with humility and remorse. Any signs of indifference, or worse a cover-up, can undermine the company’s integrity. So, I guess they’re doing the best they can.

In my opinion this is not the end all, be all. Things will be resolved eventually, and we will all one day soon sing “Kumbaya.” The great news is you can educate yourself on the data breach and Google has done an excellent job providing tips on how you can protect yourself. You can learn more about the data breach on Equifax’s website. To determine whether your personal information was exposed, click on the “Potential Impact” tab and enter your last name and the last six digits of your Social Security number. An alternative is to submit by mail your last name, and the last six digits of your social security number. Equifax also is mailing notices to people whose credit cards or dispute documents were affected.

I am hopeful you found this to be informative and an incentive to take some initiative to learn more about the Equifax data breach, how it affected you and how to now take the necessary measures to protect yourself.