It doesn’t pay to get a payday loan

Student Legal Clinic

Payday loans are short-termed loans that you must repay by the time you get your next paycheck. The lender charges you a fee plus interest on the amount you borrow.

These types of lenders usually don’t require a full credit check, which is why they are popular with people who have bad credit. Because of this, the lender is taking a large risk when they lend money, which is why payday loans have such high interest rates.

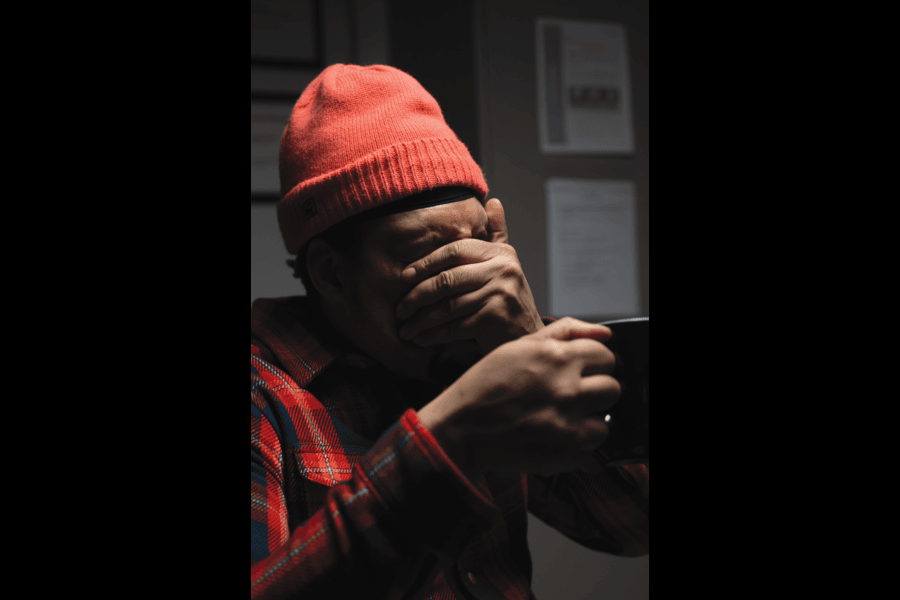

These loans create a false sense of security for customers and can easily become a malicious cycle of indebtedness. Some lenders even target those who can least afford the fees, which results in encouraging the customer to prolong their debt by rolling over the loan.

Unlike with reputable financial institutions that place limits on borrowers, there is no accountability in terms of averting customers from digging deeper holes for themselves.

The reality is that many people do not stop at using the service once and then walking away; it becomes a way of making ends meet. For the bulk of payday loan users, the service ends up being a major disadvantage and disruption in their daily lives.

Be aware that obtaining payday loans does damage credit scores and your personal financial situation may be disclosed to others if you do not pay on time, meaning privacy is non-existent. In the end, the risks are huge and the benefits little.