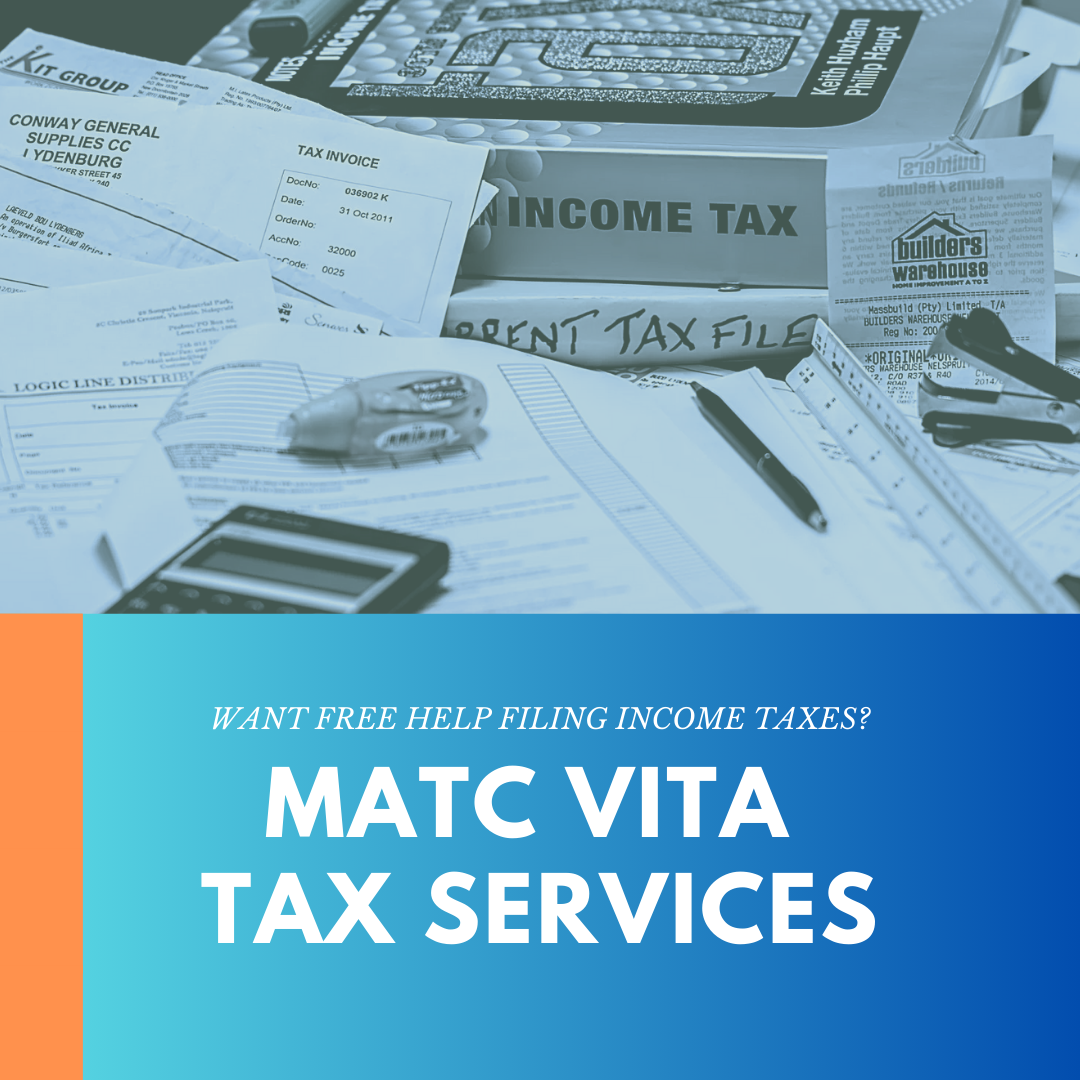

The MATC Accounting program is once again partnering with the IRS for the federal Volunteer Income Tax Assistance Program (VITA). This is a program where volunteers, and in our case – MATC accounting students, help prepare taxes for students with an annual income of less than $70,000.

These services can be accessed in two ways:

In-person: Drop off tax documentation at the MATC Oak Creek Campus (6665 S. Howell Ave.) on Tuesdays from noon-2:00 p.m. or 4:30-6:30 p.m. February 4 – April 4.

Online: Click here to easily upload images of tax documents for virtual assistance.

English isn’t your first language? No problem, the program offers assistance in multiple languages, including Spanish and Hmong.

“As a traditionally underserved group, many individuals may not be fully aware of the tax credits and deductions for which they qualify,” said Danica Olsen, MATC Accounting Instructor. “Our students are specifically trained to identify these opportunities, helping community members minimize their tax liabilities and maximize refunds.”

For more information contact MATC Accounting Instructors Nell Curtis (414-297-7461) or Danica Olsen (414-297-7243).