Proposed pre-tax resolution tackles student loan debt

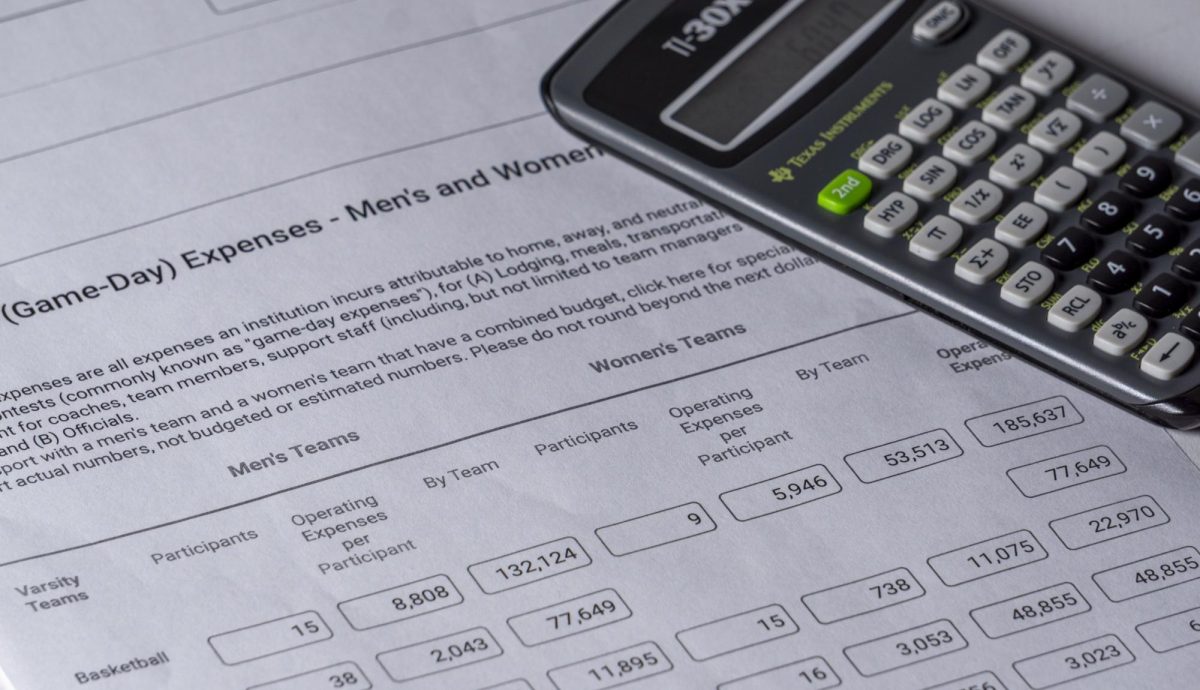

Many college students take out loans to pay for the hefty cost of their education, often leaving them with tens of thousands of dollars of debt. Large monthly loan payments combined with other bills can send students into financial devastation.

After attending a New Orleans Leadership Conference held by the American Student Association of Community Colleges (ASACC), MATC student Kevin Richter decided to get involved in MATC Student Life. Richter came up with a resolution to reduce the national student loan debt by using a pre-tax dollar contribution. Like a flex spending account, employees could fill out forms that would allow their employers to deduct a certain amount of money from their paychecks that would go toward their student loan payments.

Students contributing pre-tax dollars would not be eligible for a student loan interest tax deduction. According to Richter, a student graduating from MATC and paying back around $3,500 a year would save about $800. That is about $350 more than the tax deduction.

Richter met with former SGA Mequon campus President Robb Rusch and ASACC co-founder Jerry O’Sullivan. The three of them bounced ideas off each other. “We felt that the idea of being able to use pre-tax dollars to pay off student loans had the most potential to have an impact,” said Richter in an email interview. They felt that student loan debt negatively affects students’ quality of life after graduation, and that debt is a huge problem in America. “Student loan debt is the highest debt and growing every minute, even higher than credit card debt,” said Richter.

Determined to raise awareness, Richter and Rusch contacted U.S. Congressman Paul Ryan and Yahoo! News CEO Marissa Mayer. With major elections coming up Richter hopes to gain support from both political parties, as the student loan debt issue is bipartisan.

Rusch and Richter took their proposal to the District Student Senate (DSS), who offered their support. They were able to present their idea to Capitol Hill legislators at the National Advocacy Conference held by ASACC in Washington, D.C.

“Our idea is directed at anyone with student loan debt, not just the MATC community. This will not only benefit the community by having residents with more money in their pockets, but the government as well,” Richter said.