Federal loan checks to be cut in half, sent twice

Photo by Tribune News Service

MATC students will be receiving their spring semester federal student loan disbursements in two equal payments, according to a series of three emails distributed to students by Camille Nicolai, Department of Student Financial Aid and Employment Services director. The second disbursement will happen on March 18, one month after the initial disbursement.

MATC has had a default rate for first-time borrowers of over 15 percent for three consecutive years, and it was mandated by the federal government that if this occurs then the college has to take preventative actions. MATC made the decision to have double disbursements for all students and not merely the first-time borrowers as required by the government. Nicolai communicated that the change in cutting the disbursement payments into two monthly dates across the board for all students will create clear communication, instead of having different payment dates for each group. The goal is to keep students Title IV eligible, because if not, they are going to risk being disqualified for receiving any type of government-funded Pell grants. The department stressed the importance of keeping up with your academic status. Different statuses that qualify to receive financial aid include: good, warning, probation with financial aid, or monitored academic plan with financial aid.

This decision was partly focused to prevent those students who do not complete 60 percent of classes in a semester from creating a large debt for themselves because that money will have to be paid back in full. Double disbursement will make the students more money savvy. “When you are a student, you should live like a student so you don’t have to live like one when you are not,” Nicolai stated.

Nicolai expressed her deep concern for the students of MATC. She and her staff are available for the students to come in and communicate with the department so that all questions can be addressed as to why these changes had to take place.

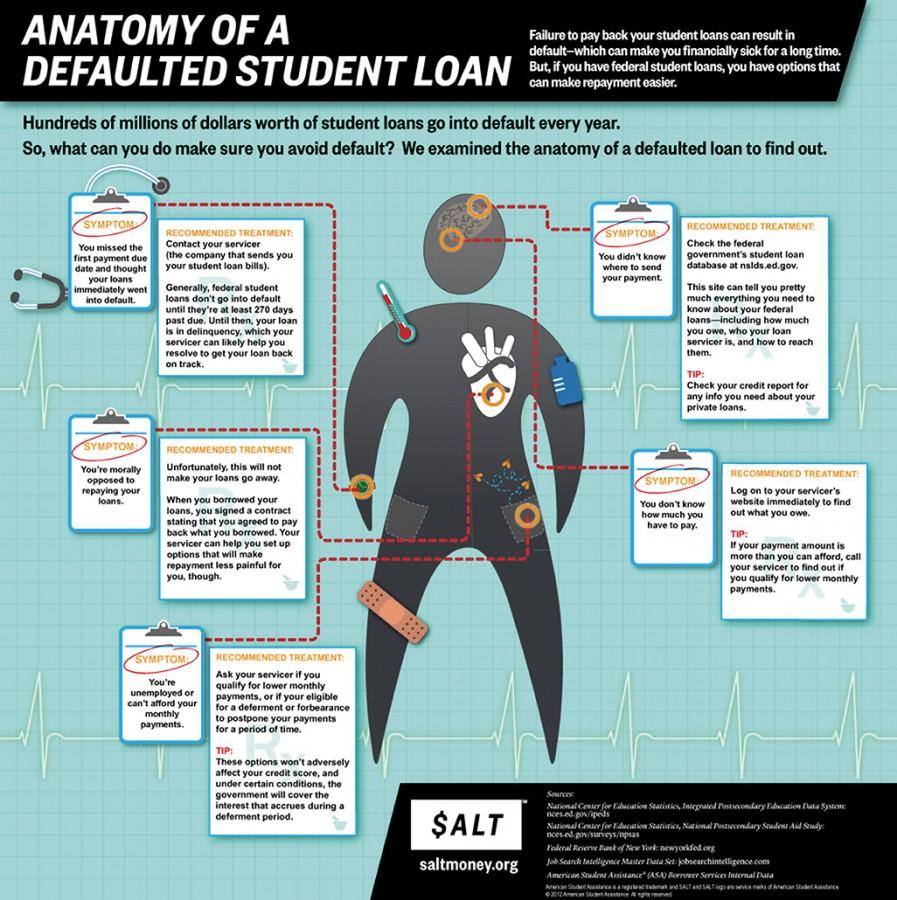

The department likes to educate students on financial choices to help manage school debt. Saltmoney.org is an informative tool and a requirement by the financial aid office for students to participant in if they are applying for additional loans, and it is advised that other students visit the website for their financial education.