Free help with tax returns offered at MATC’s Downtown Milwaukee and Oak Creek campuses

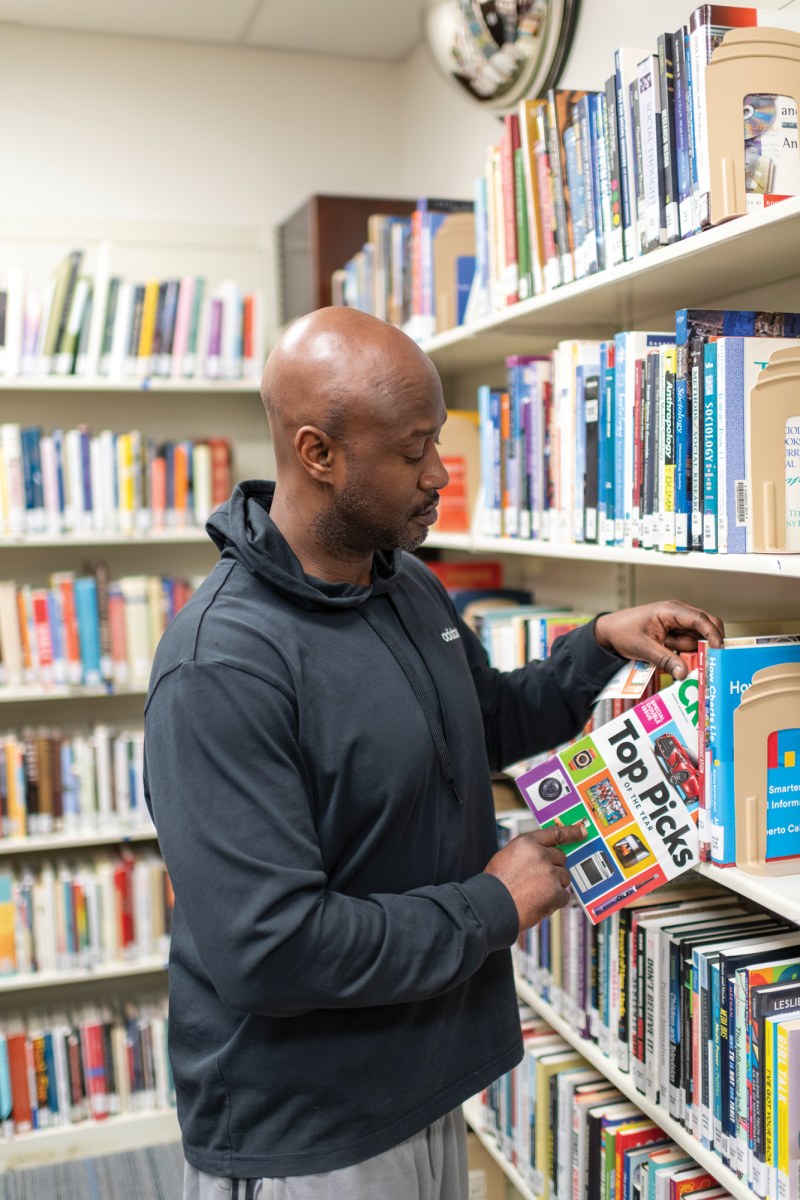

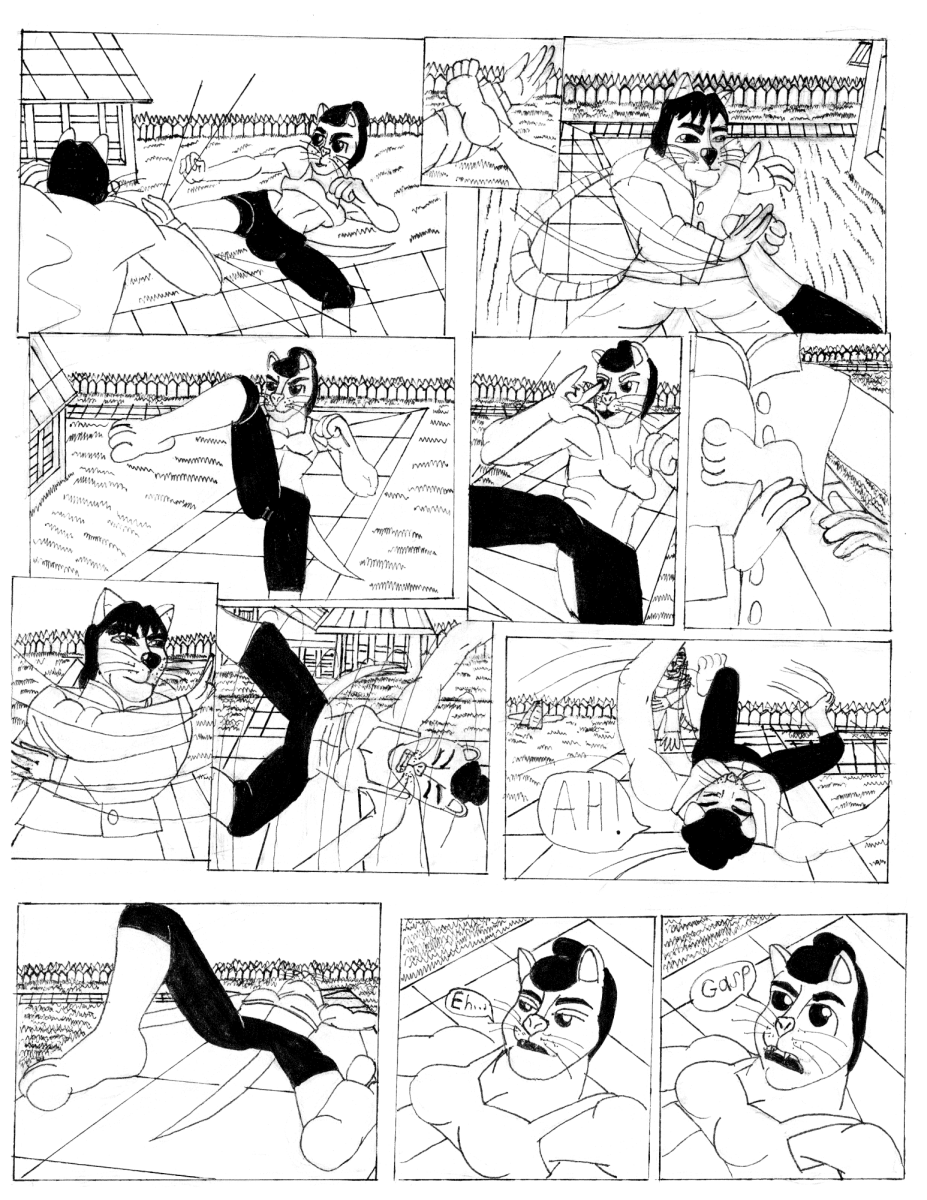

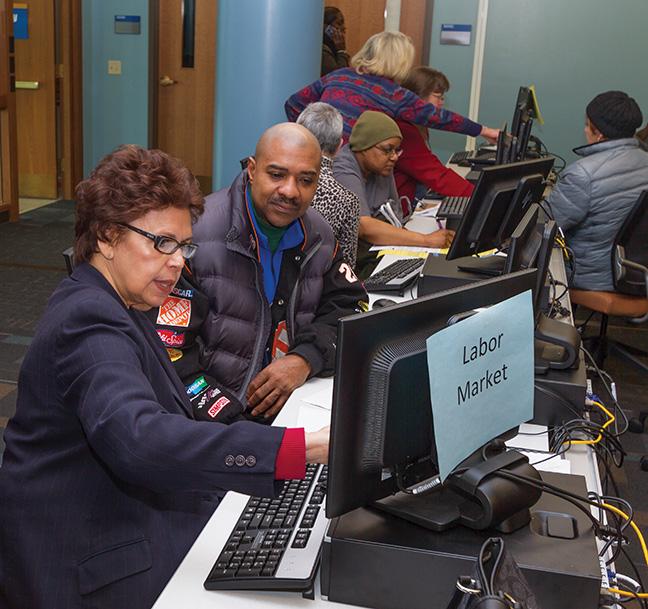

Photo by Leo Strong

Volunteer tax preparer Betty Fuentes compiles information for Andrae Wilson’s tax return.

Taxpayers with a family income of $53,000 or less are eligible for free help preparing their basic personal income tax returns at Milwaukee Area Technical College’s Downtown Milwaukee campus, 700 W. State St.; and Oak Creek campus, 6665 S. Howell Ave.

MATC accounting students provide the service in cooperation with the Wisconsin Department of Revenue and Internal Revenue Service Volunteer Income Tax Assistance (VITA) programs. Volunteers are trained by the Internal Revenue Service and supervised by MATC instructors and staff. MATC’s VITA sites are sponsored by Guaranty Bank.

All returns are e-filed to ensure speed and accuracy. Now in its 33rd year at the Oak Creek campus and its 13th year at the Downtown Milwaukee campus, the program heightens awareness of Wisconsin’s Homestead Credit; federal and state education credits; and the Earned Income Credit, an often overlooked federal tax break for low-income working people who are raising children in their homes.

Downtown Milwaukee

dates and hours

Tax help will be offered Tuesdays and Saturdays through April 14. Tuesday sessions will be held 6-7:30 p.m. and Saturday sessions will be held 10 a.m-1:30 p.m. There will not be a session on Saturday, April 4. The first 20 clients will receive assistance Tuesdays and the first 30 clients will be served on Saturdays. Registration begins one hour before start time. Go to the Information Desk on the first floor of the Student Center, 700 W. State St. A Spanish translator will be available to provide assistance.

Oak Creek dates and hours

Tax help will be offered Thursdays and Saturdays through April 2. Thursday sessions will be held 4-7 p.m. and Saturday sessions will be held 9 a.m.-noon. Go to Room A120 in the A Building.

Attendees should bring the following:

Proof of identification (photo ID)

Social Security cards for you, your spouse and dependents; or a Social Security number verification letter issued by the Social Security Administration. (An Individual Taxpayer Identification Number (ITIN) assignment letter may be substituted if you do not have a Social Security number.)

Proof of foreign status, if applying for an ITIN

Birth dates for you, your spouse and dependents on the tax return

Wage and earning statements (Form W-2, W-2G, 1099-R,1099-Misc) from all employers

Interest and dividend statements from banks (Form 1099)

A copy of last year’s federal and state returns, if available

Proof of bank account routing and account numbers for direct deposit such as a blank check

Total paid for daycare provider and the daycare provider’s tax identifying number such as their Social Security number or business Employer Identification Number

Forms 1095-A, B or C, Affordable Health Care Statement, if applicable

Copies of income transcripts from IRS and state, if applicable

Copy of 2014 property tax bill or rent certificate signed by your landlord

Taxpayers filing a joint return must both be present when the returns are prepared, because both spouses must sign a joint tax return.

This is the second year Guaranty Bank has supported the MATC VITA program. “We’re excited to partner with Milwaukee Area Technical College as they provide valuable support to the community during tax season,” said Nina Johnson, senior vice president of Guaranty Bank. “We partner with VITA organizations throughout our footprint because we believe that it is a great way to show how committed we are to the community. For more than 90 years, we have dedicated ourselves to supporting hardworking families. Our chairman, Gerald Levy, and CEO Doug Levy have always reinforced the importance of community in light of the bank’s mission. Guaranty’s dedication to helping customers achieve their financial dreams is demonstrated through a wide array of products such as our latest innovative solution, ‘Credit Builder,’ a $1,000 loan and savings product that is used to help customers build and repair their credit scores,” Johnson said. “We look forward to supporting MATC’s VITA initiative and providing their clients with solutions that strengthen their overall credit rating.”

A free self-service tax filing website for individuals or families with a combined household income of $60,000 or less in 2014 is available at http://www.myfreetaxes.com.

Guaranty operates more than 120 branches in five states including Wisconsin, Minnesota and Illinois; and in Michigan and Georgia under the BestBank banner. “As one of the top 10 supermarket banks in the country, Guaranty is firmly committed to serving hardworking families and providing customers with the most accessible and convenient banking experiences possible,” Johnson said.

For more information, call Bobbie Sherrod, 414-297-8417, at the Downtown Milwaukee campus; or Jim Benedum, 414- 571-4757, at the Oak Creek campus.